Corporate Income rates.

The standard CIT rate for legal entities is 21%

In case of taxable income up to EUR 49 790 for taxing period, legal entities or self – employed individuals can apply rate 15% .

The standard CIT rate for individuals is 19%; in case when tax base for year is over EUR 47 537,98 tax rate is 25%.

Rate for witholding tax is 19 %.

In specific situation is rate 35 % – for payments to taxpayers from non-cooperative juridictions ( list of Non-cooperting Countries or a zero rate applies )

Rate for witholding tax to dividend payment to individuals is 10 % ( for dividends payed for 2023 or earlier is rate 7 % )

Tax free allowance and tax bonus to children for individual.

Personal allowances for the individuals, whose tax base is lower than EUR 24,952,06 have been EUR 5,646.48 a year ( EUR 470,50 a month) ; if the tax base is higher than EUR 24,952,06 the personal allowance is progressively reduced to nil and those individuals with an annual tax base exceeding EUR 47 537,98 are not entitled to any personal allowance;

Maximum annual tax bonus for dependent children for the year 2024 has been set to EUR 50 / month if the dependent child has reached 18 years of age, and EUR 140 / month if the dependent child has not reached 18 years of age. Value of the tax bonus is limited by the taxpayer’s tax base and number of dependent children.

| Number of dependent children | Percentage limit of the tax base |

|---|---|

| 1 | 20 % |

| 2 | 27 % |

| 3 | 34 % |

| 4 | 41 % |

| 5 | 48 % |

| 6 a viac | 55 % |

Deadline for filling income tax return.

The tax return should be filled and also paid up to three calendar month following the end of the fiscal eyar. Usually it is 31st.March, because taxable period is calendar year, but legal entity can agreed different financial year. The term can be extended for longer period ( plus 3 or 6 months ) by sending a notice of an extension of the term of filling tax return.

Tax loss.

Companies, or self – employed individuals may carry forward and utilise tax losses as follow :

Tax losses reported up to 2019 including, can be utilise in four following year evenly ( 25 % every following year, no longer than 4 years )

Tax losses reported since 2020 can be utilise during consecutive tax periods, up to 50% of tax base in reported actuall tax period.

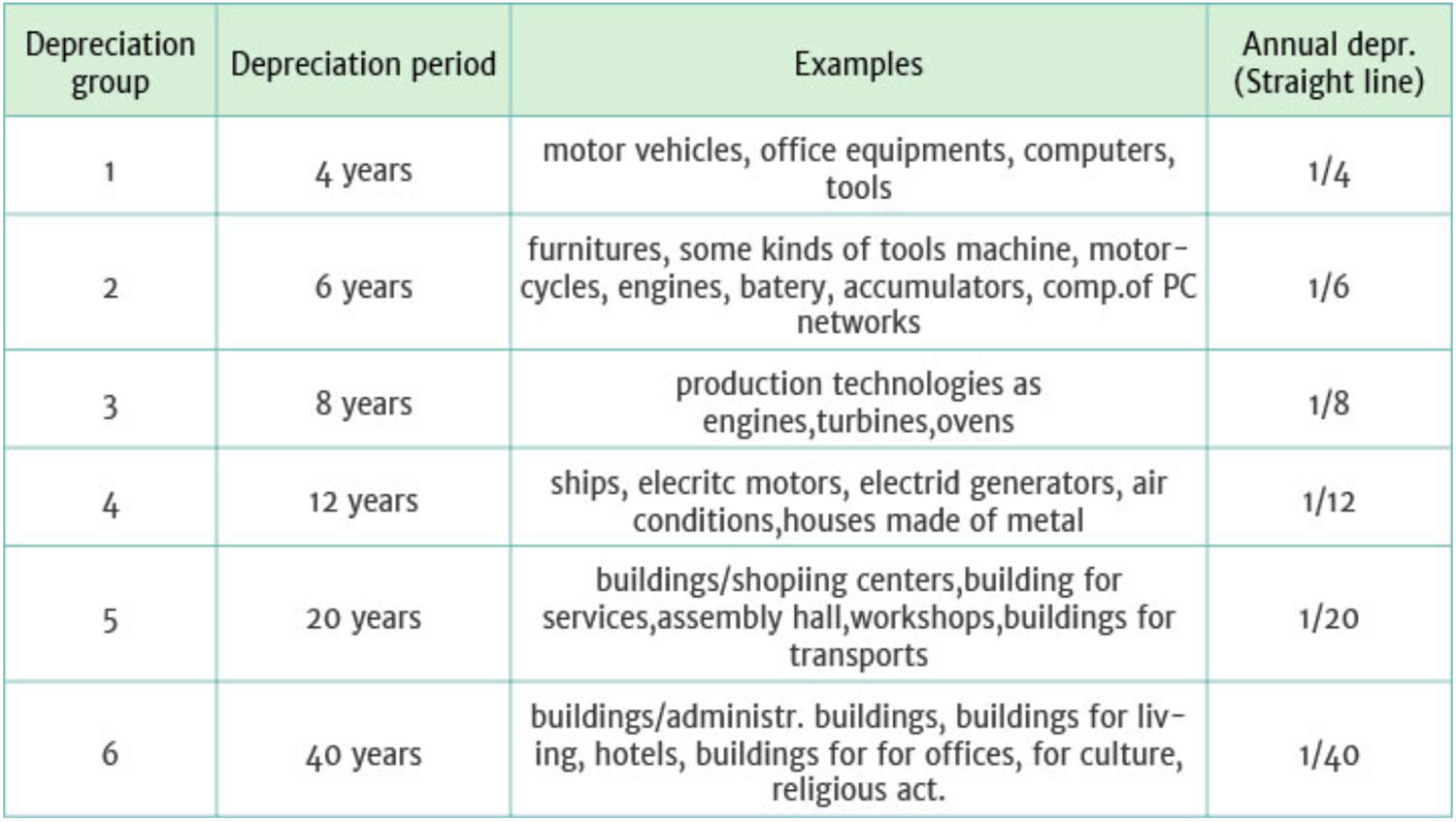

Depreciation.

Tangible fixed assets for tax purposes have been defined as any tangible property with the acquisition price higher than 1,700 € and with the usable life no shorter than one year. Such assets are classified into tax depreciation groups to which different tax depreciation periods apply.

Intangible fixed assets, according to the Act on Income Tax, is any property of intangible nature with the acquisition price higher than 2,400 € and with the usable life of at least one year. Intangible fixed assets are depreciated based on the actual usage period and it is equal with the accounting depreciation;

Land is excluded from depreciation

USEFULL

INFORMATIONS